does shopify provide tax documents

However always proceed with caution as tax evasion is a different story. Does Shopify provide tax documents.

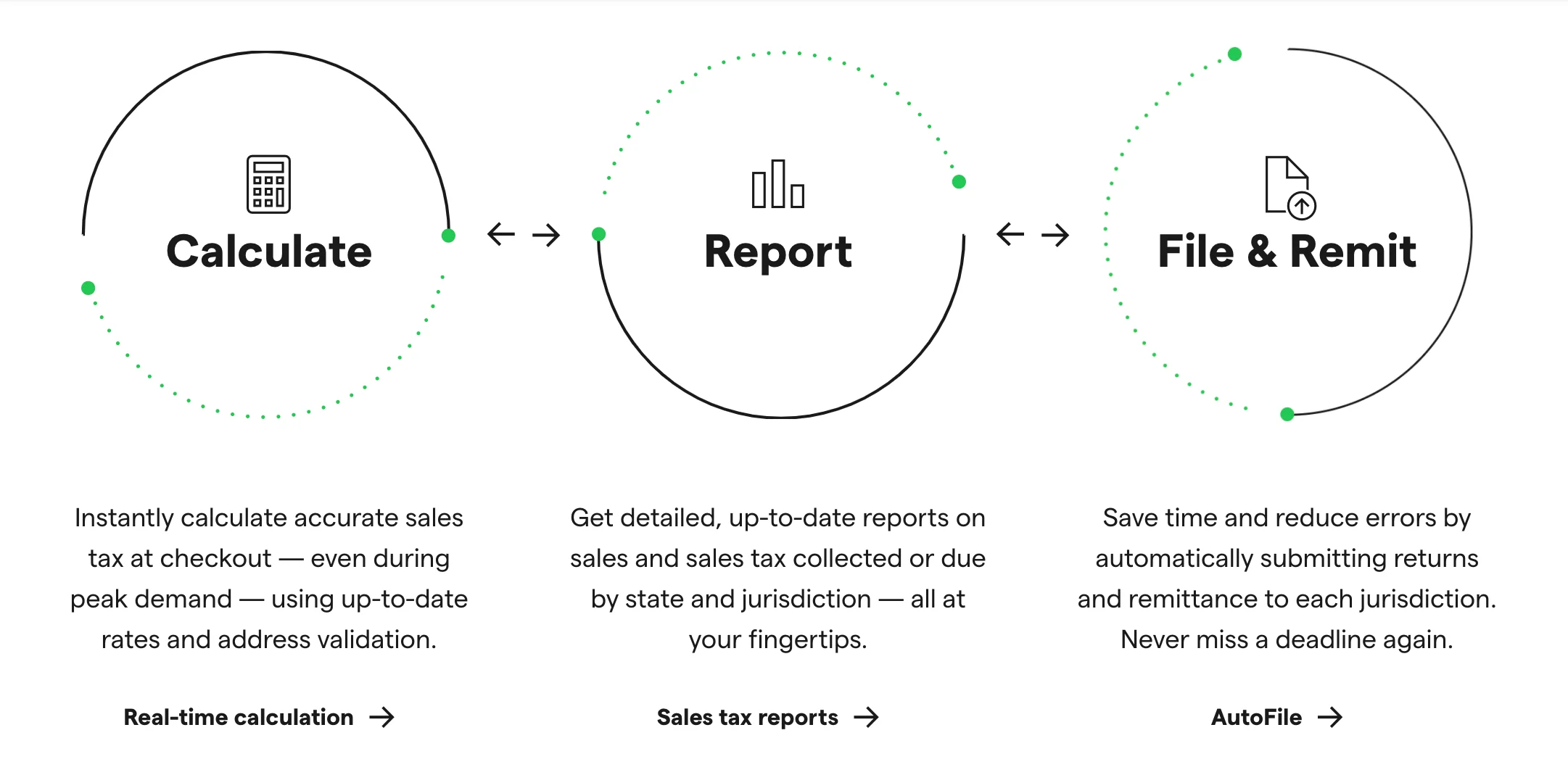

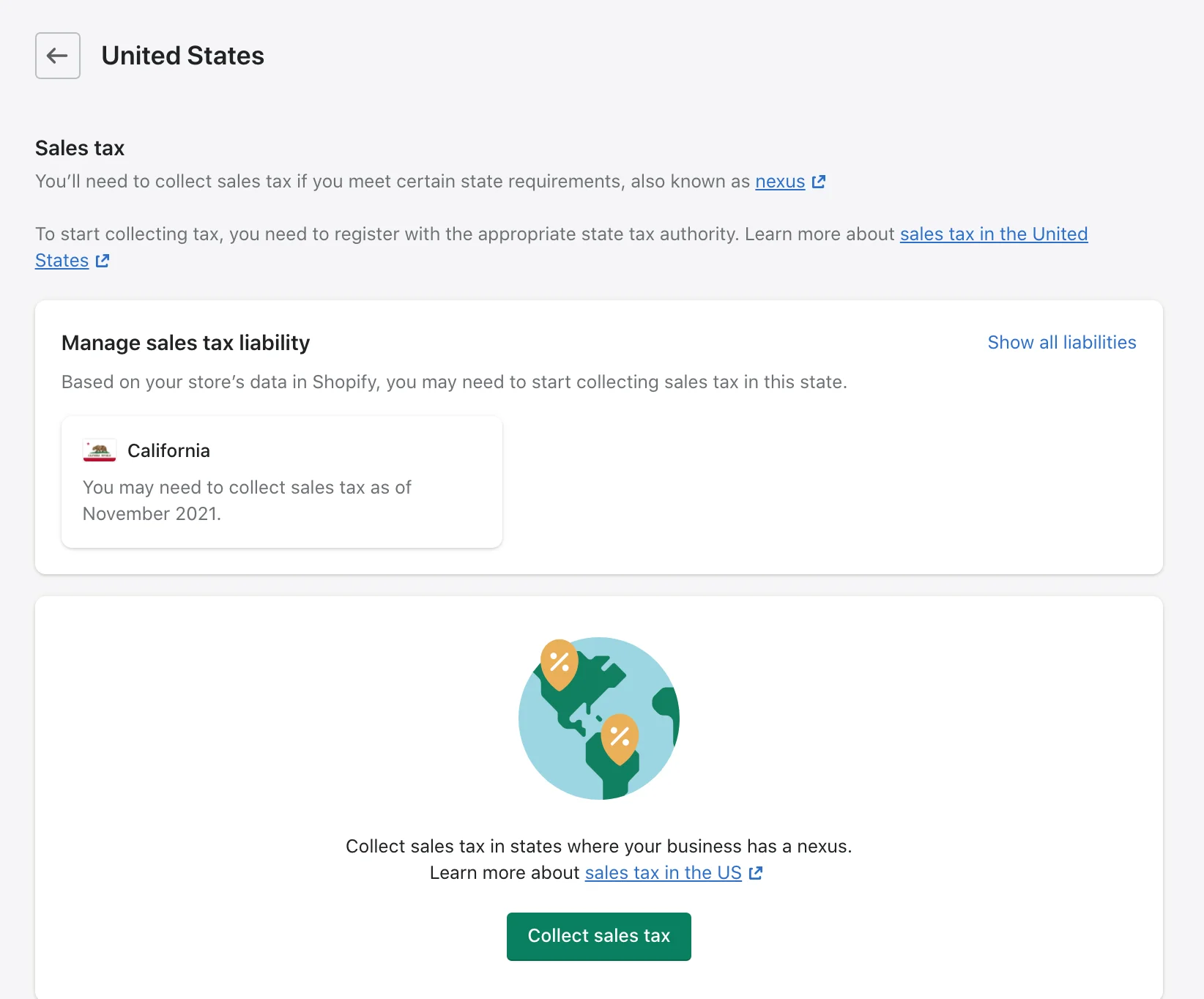

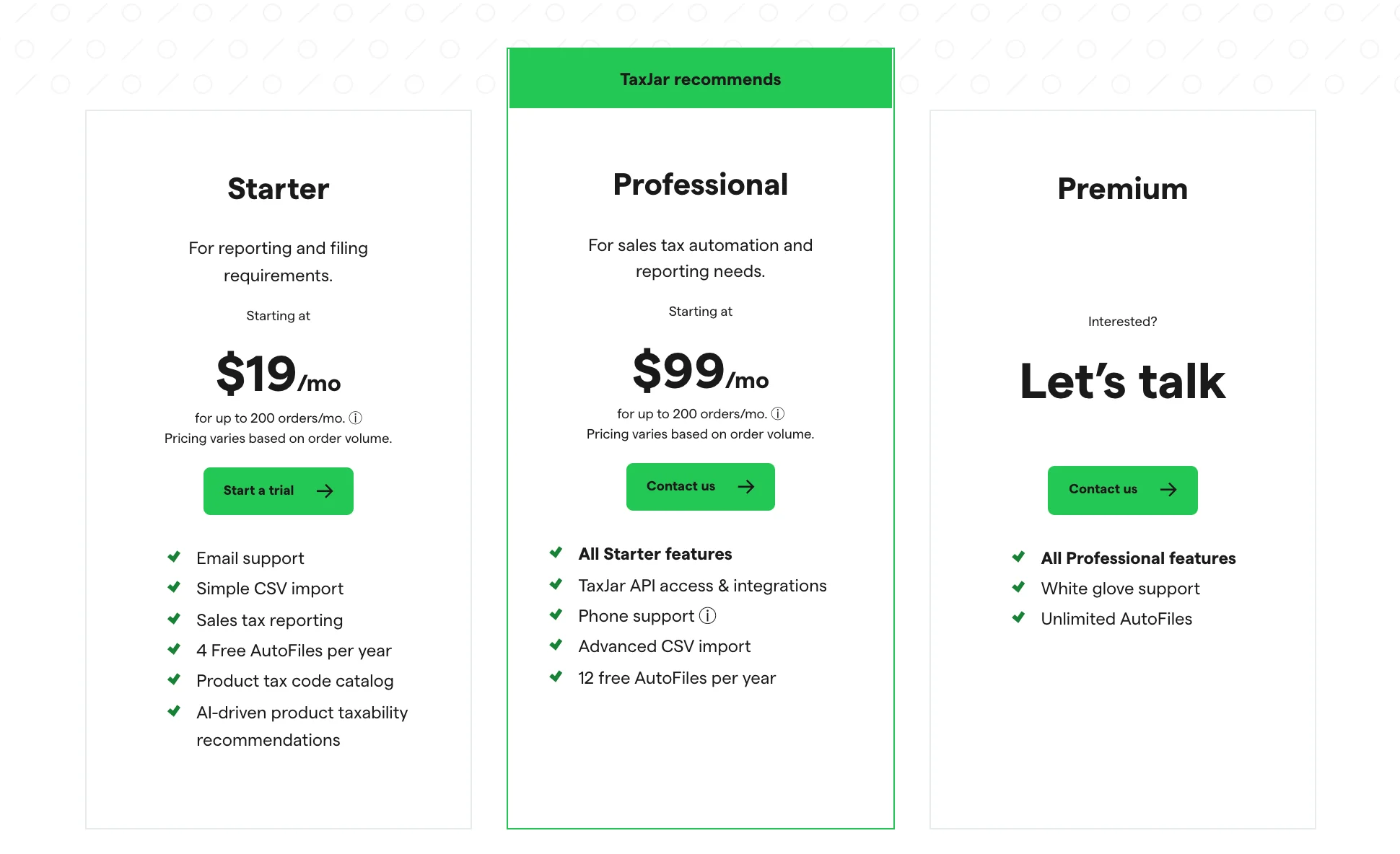

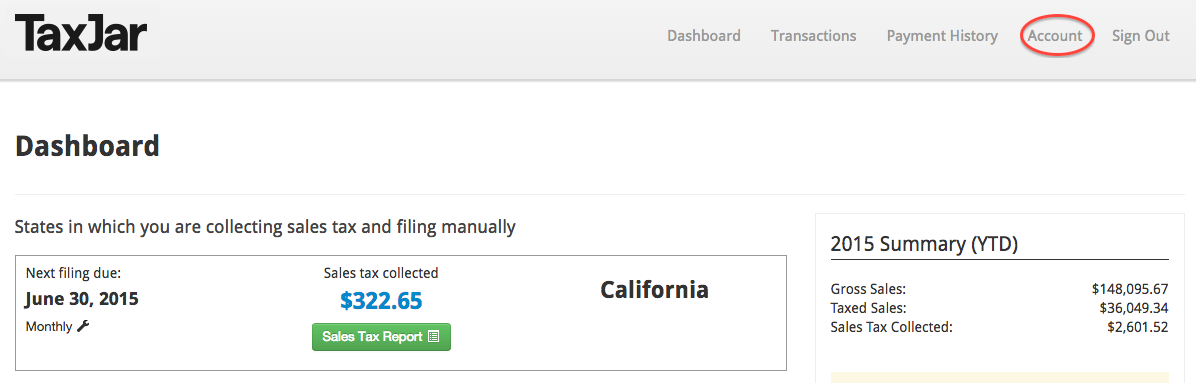

Sales Tax Liability 5 Things To Know For Your Shopify Store Taxjar

March 15 is the deadline to file your corporate tax return forms 1120 and 1120S or apply for a tax extension.

. How To Track Sales Tax. These guidelines illustrate how Shopify balances our legal obligations the requesting partys needs and the privacy rights of our Merchants their Customers and Partners when we receive legal requests for information. The economic nexus changes now require your business to track all your taxable sales in all 45 taxable states and DC.

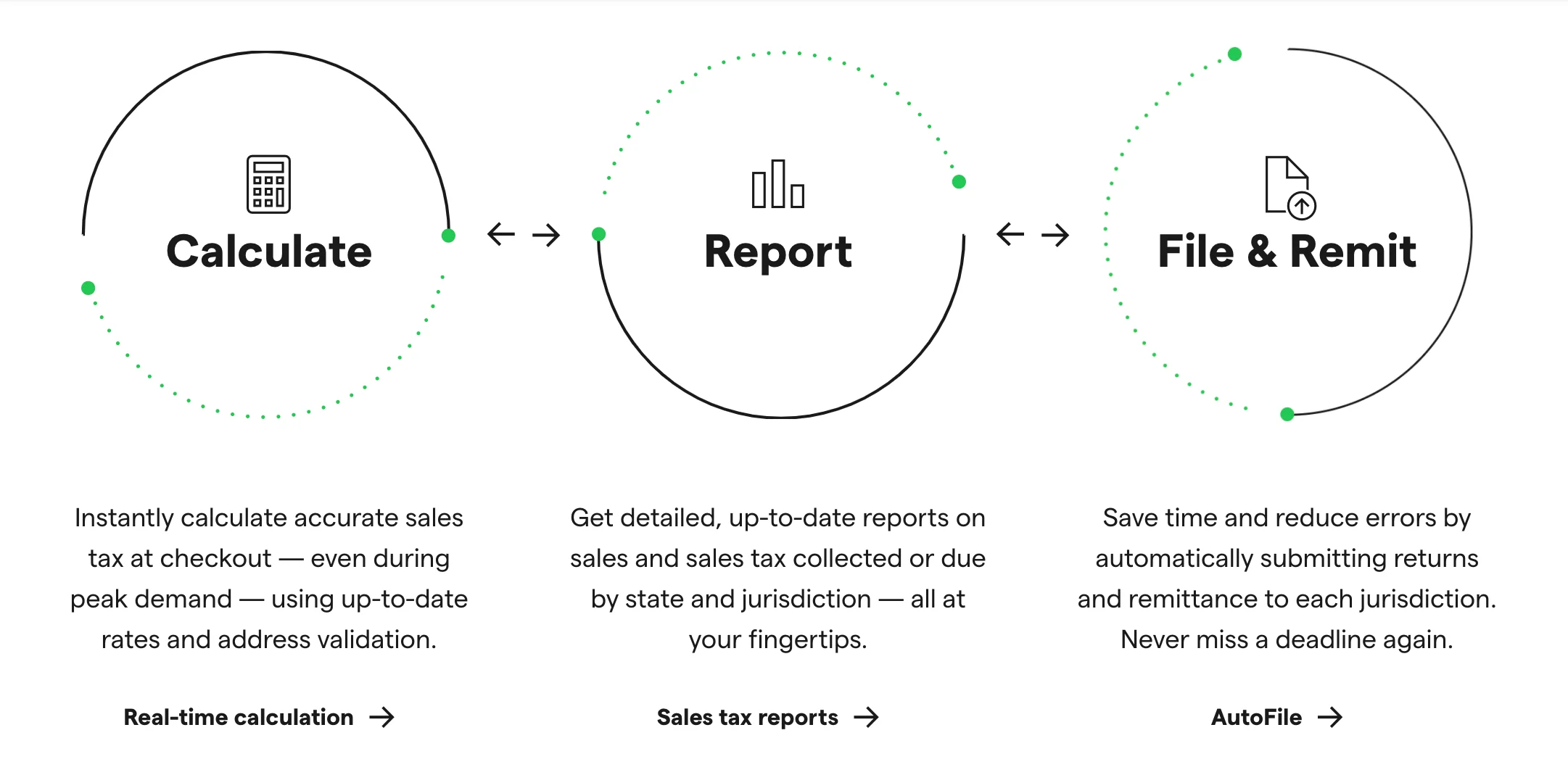

Does Shopify send tax forms. Select your store address. Long story short you should collect tax on the basis of state tax laws depending on which state the goods are purchased from.

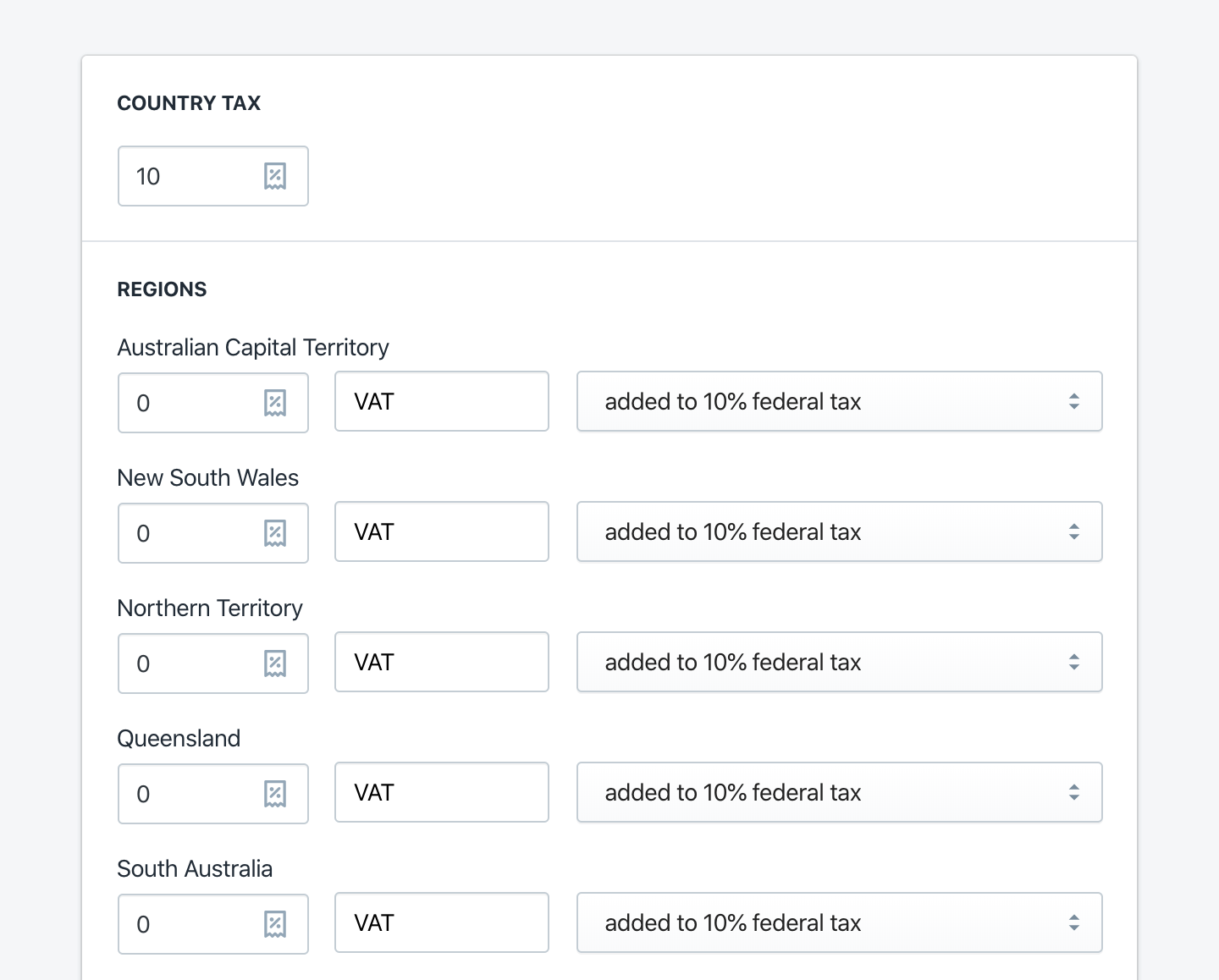

How to file your Shopify 1099-K and claim your write-offs. Shopify stores that ship to Canada the tax rate is 0 as default however for Canadian stores the federal tax rate for Canada is 5 as default. General set-up steps and tax reports.

If youre a sole proprietor you will need Schedule C and Schedule SE. Tax exempt at checkout. Its close to an invoice but its missing a few key elements like your.

To go more in detail Shopify works based on other default sales tax rates which are often. To create a shipping zone. Then click on Export in the upper right-hand corner.

There are five main steps for setting your store up for Shopify sales tax. You can see this by going to your Billing Settings Finance Overview. Therefore Shopify doesnt fall under marketplace facilitator laws that require stores like Amazon or Ebay to collect and remit sales tax for its sellers.

You then collect the taxes and remit them based on the schedule the state assigns you. When you login to your Shopify account youll be on your home screen. Select the product you want to override.

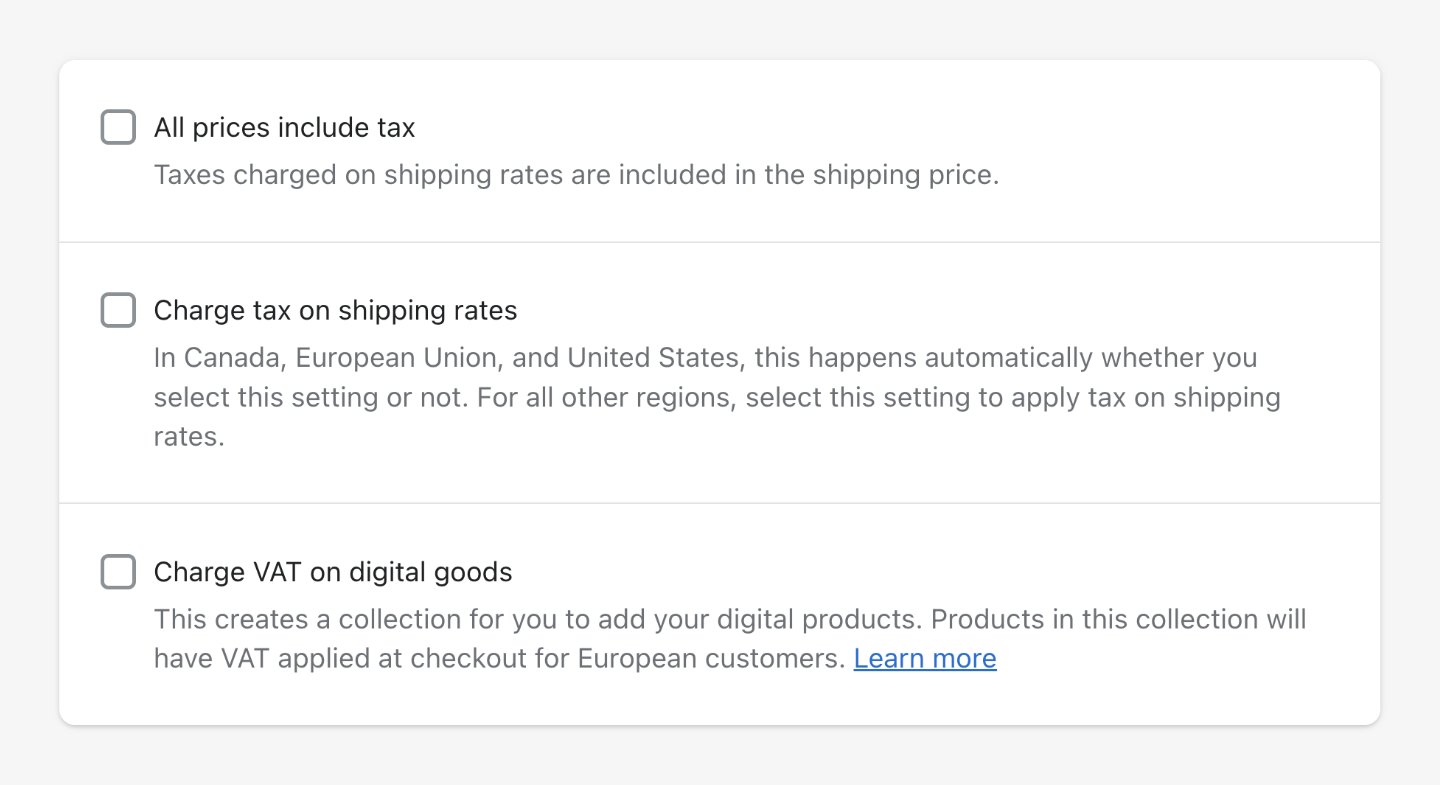

Lucky you Shopify does provide some tools that can make your Shopify tax preparation a bit easier. Sorry to hear youve been having issues collecting taxes. There is no VAT on UK Shopify fees but it is accounted for as a 20 reverse charge.

Ad Best POS System. Head over to Settings Shipping in your Shopify admin dashboard. The earlier deadline gives partners a chance to receive Schedule K-1s before the personal tax return due date.

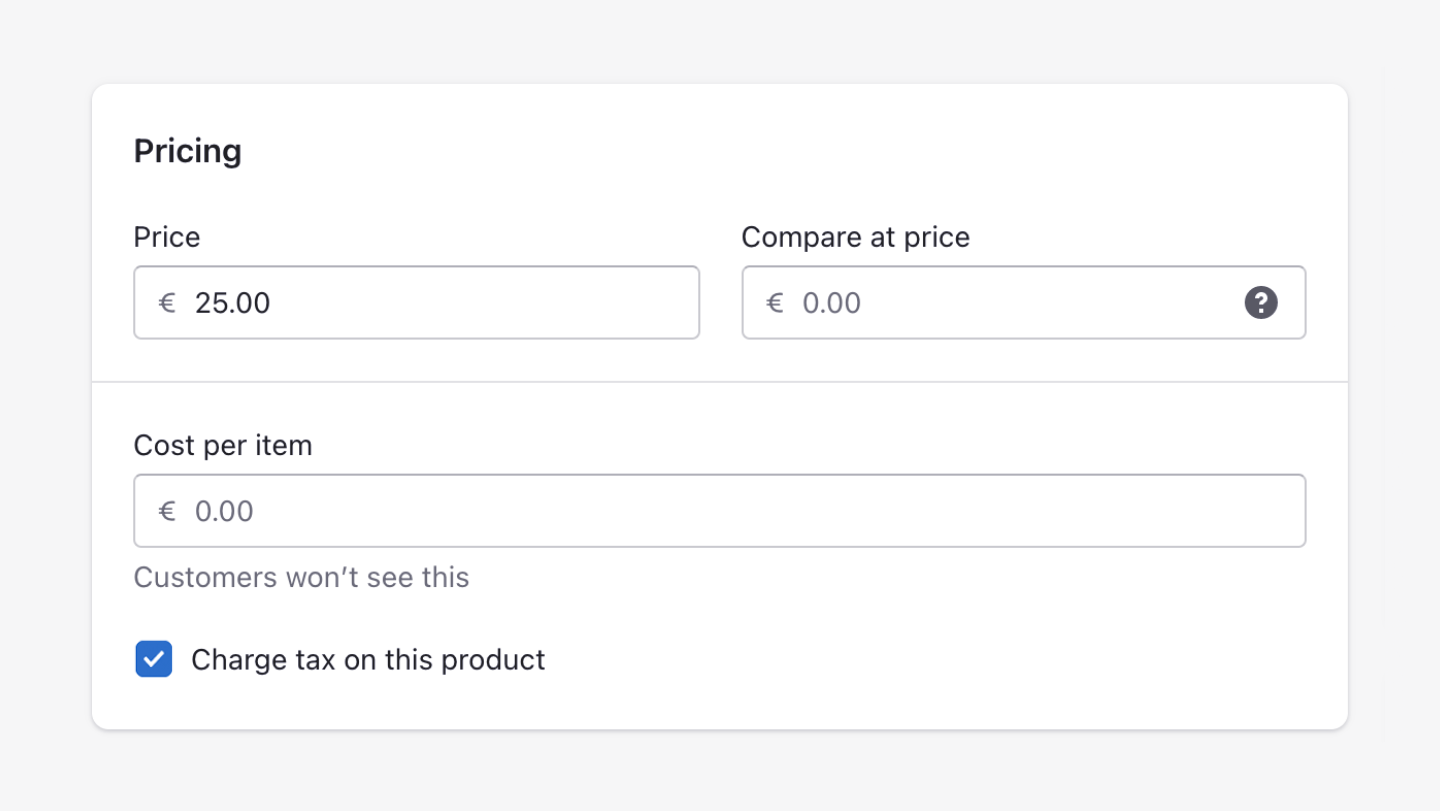

Include taxes in all your product prices. However tax laws and regulations seem to be complex and often change through times. Uncheck charge tax on this product.

Step 3- The Tax Exemptions. You will see a section at the top of the screen that says manage. After that follow your Shopify Admin to Settings and Taxes.

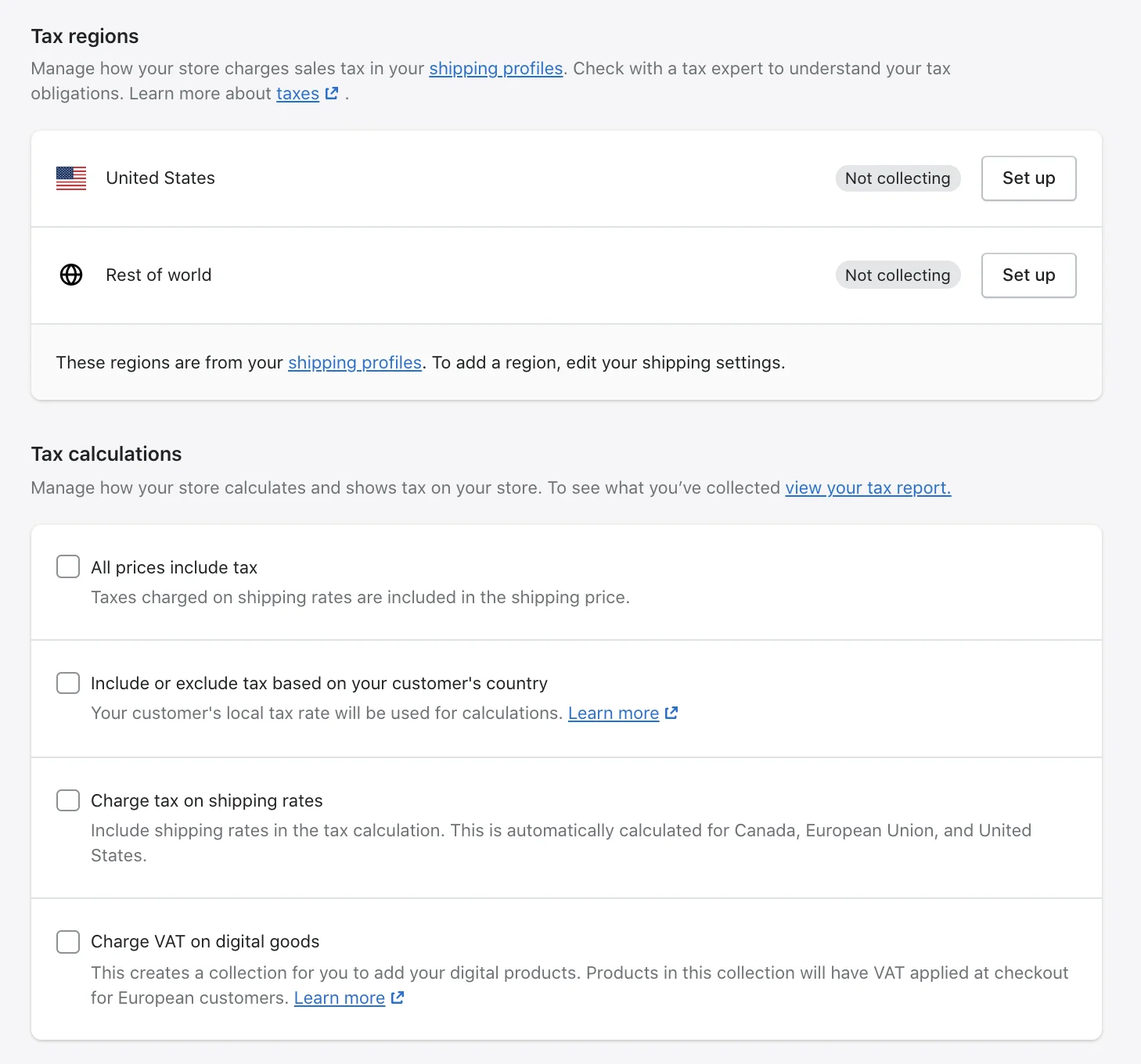

Heres how you can access Shopifys new sales tax liability dashboard to monitor economic nexus. Hope this helps and answers your question. Then in the Tax rates section click on United States.

Override tax rates or exempt products from taxes where necessary. Finding Your Shopify Sales Tax Report. Thatll open a list of all your orders.

To help with your sales tax reporting you can download a taxes finance report and a sales finance report to collate information on order amounts taxes POS billing. If your business is registered in the UK there is no VAT to be paid on Shopify fees and it has a 20 reverse charge tax treatment. Theres a manual and automatic tax setting for the US.

In addition specify whether you will charge taxes on shipping. In your Shopify admin go to the Settings Shipping and delivery page. It will look something similar to the screenshot below.

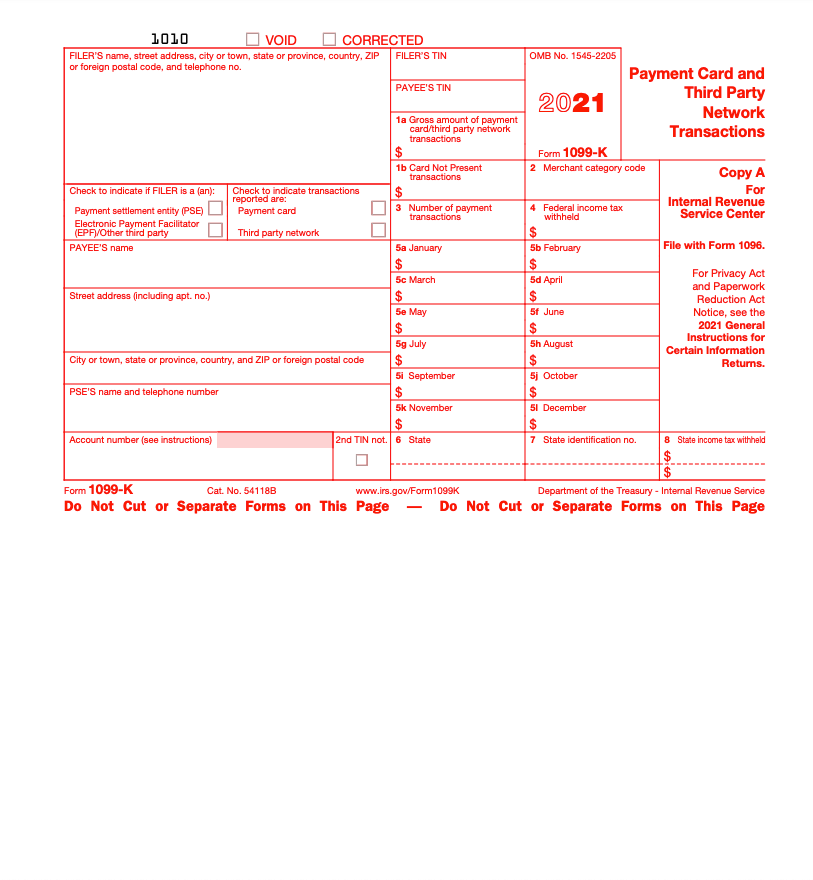

Once you have your Shopify 1099-K and found transaction history from your store its time to fill out the necessary tax forms and file your taxes. Navigate to Products from your admin dashboard. If you do not see the country in the Tax regions list you will need to create a shipping zone first.

Welcome to the Shopify Community and congratulations on your launch. Next add the regions for which you have nexus such as a. Theres a Base Taxes section where you can pick the rates for each state the you sell to.

For instance the US. Make sure you have an American store address in a US shipping zone for the manual one. This is totally separate from income taxes.

Then those taxes will be reported and remitted to your government. Uncheck the Calculate Taxes Automatically button. Merchants are the businesses who use Shopifys platform to power their stores in any capacity.

There are many ways to legally reduce ones tax bill. You should always check with a local tax authority or a tax accountant to make sure that you charge your customers the correct sales tax rates and to make sure you file and remit the taxes correctly. Step 2- Set Up The Tax Rates.

Does Shopify Provide Tax Documents. Happy to provide some guidance. From your Shopify admin go to Settings Taxes.

So the Shopify seller is responsible for remitting sales tax to the states. For Shopify Sellers. Before you start collecting you need to register for a state sales tax permit.

If you sell digital products then set up the taxes that apply to these items. Tax planning helps businesses reduce their tax liability in a legal way. Shopify is not required to collect and remit sales tax in behalf of its sellers.

First you must correctly add your store address to Shopify so that local and remote sales taxes are applied correctly. 11-04-2021 0606 PM. Does Shopify Provide Tax Documents.

In the Shipping section click Manage rates Create shipping zone. Selling in the EU for example is different because you only have one country at a time to determine if you passed the. Click on Orders in the upper left-hand corner.

To determine when you cross these new thresholds unless the state is a marketplace nexus state. Understanding how to properly fill taxes for your Shopify store will ensure that you are meeting the necessary legal requirements for your area. You collect sales tax in any state you have nexus in based on the location of the customer.

Here you will be able to see all the fees which you can sort by date and print the statement. Were not able to provide any legal tax advice we always recommend consulting a local tax authority or tax professional. Step 1- Formation Of Shipping Zones.

From the Shopify admin go to Settings General and enter your correct physical store address. Heres how you can calculate sales tax for your store on Shopify. Corporate Tax Returns Due.

Here are the steps to follow. Working with a professional Shopify tax accountant is the safest way to take advantage of the benefits from tax planning. Business license business registration documents with company number or business tax filing record.

If you want Shopify to calculate the taxes for you automatically check the Calculate taxes automatically option in the Calculating taxes section. Any overrides that you set apply to online sales and to Shopify POS sales. Type in the name of the shipping zone add the country or countries you are VAT-registered in using the search.

You can get these forms from the IRS official website wwwirsgov. March 15 is the deadline to file individual and partnership tax returns. There are certain rules and regulations you should be aware of before you start.

The Shopify Payments Service.

Finding And Filing Your Shopify 1099 K Made Easy

How To Charge Shopify Sales Tax On Your Store June 2022

How To Charge Shopify Sales Tax On Your Store June 2022

Tax Exempt Manager Increase Sales By Offering Vat Exemption For Eu B2b Customers Shopify App Store

How To Charge Shopify Sales Tax On Your Store June 2022

Why Are Taxes Missing On My Shopify Orders And Invoices Sufio For Shopify

How To Charge Shopify Sales Tax On Your Store June 2022

Shopify Sales Tax Setup Where And How To Collect Ledgergurus

Shopify Sales Tax Setup Where And How To Collect Ledgergurus

Include Or Exclude Tax From Product Prices In Shopify Sufio For Shopify

How To Charge Shopify Sales Tax On Your Store June 2022

Sales Tax Liability 5 Things To Know For Your Shopify Store Taxjar

Form 1099 K Why You Need It And Where To Find It Bench Accounting

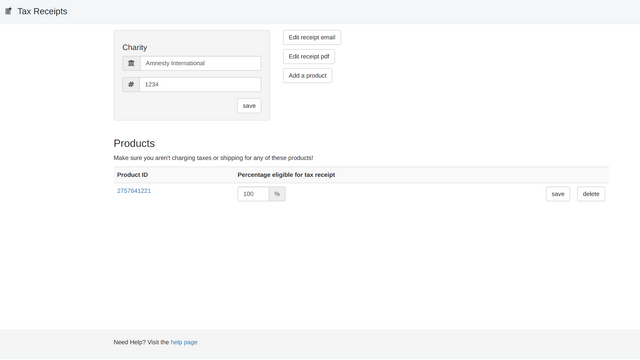

Tax Receipts Customizable Donation Receipts For Your Customers Shopify App Store

Sales Tax Guide For Shopify Sellers Taxjar Developers

Set Up Australian Taxes In Your Shopify Store Sufio For Shopify

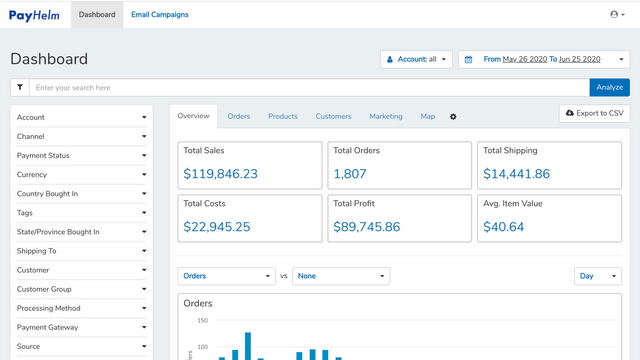

Accounting Tax Data Reports Accounting For Sales Orders Inventory Tax Profits More Shopify App Store