infrastructure investment and jobs act tax provisions

Infrastructure Investment and Jobs Act Tax Provisions Barry S. While the bulk of the law is directed toward massive investment in infrastructure projects across the country a handful of noteworthy tax provisions.

Biden Infrastructure Plan How It Affects You And Your Money Ramseysolutions Com

House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill.

. November 12 2021. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill.

Roads bridges and major projects. The Bipartisan Infrastructure Investment and Jobs Act extends prevailing wage protections to all energy infrastructure provisions including the construction of EV charging stations on highways. Almost three months after it passed the US.

While the bulk of the law is directed toward massive investment in infrastructure projects across the country a handful of noteworthy tax. The Infrastructure Investment and Jobs Act Includes Tax-related Provisions Youll Want To Know About 11921 Almost three months after it passed the US. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill.

November 11 2021 November 22 2021 Kim Paskal. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill.

Senate passed the same version of the bill on August 10 2021 on a bipartisan basis. Here is what you need to know. Infrastructure Investment and Jobs Act.

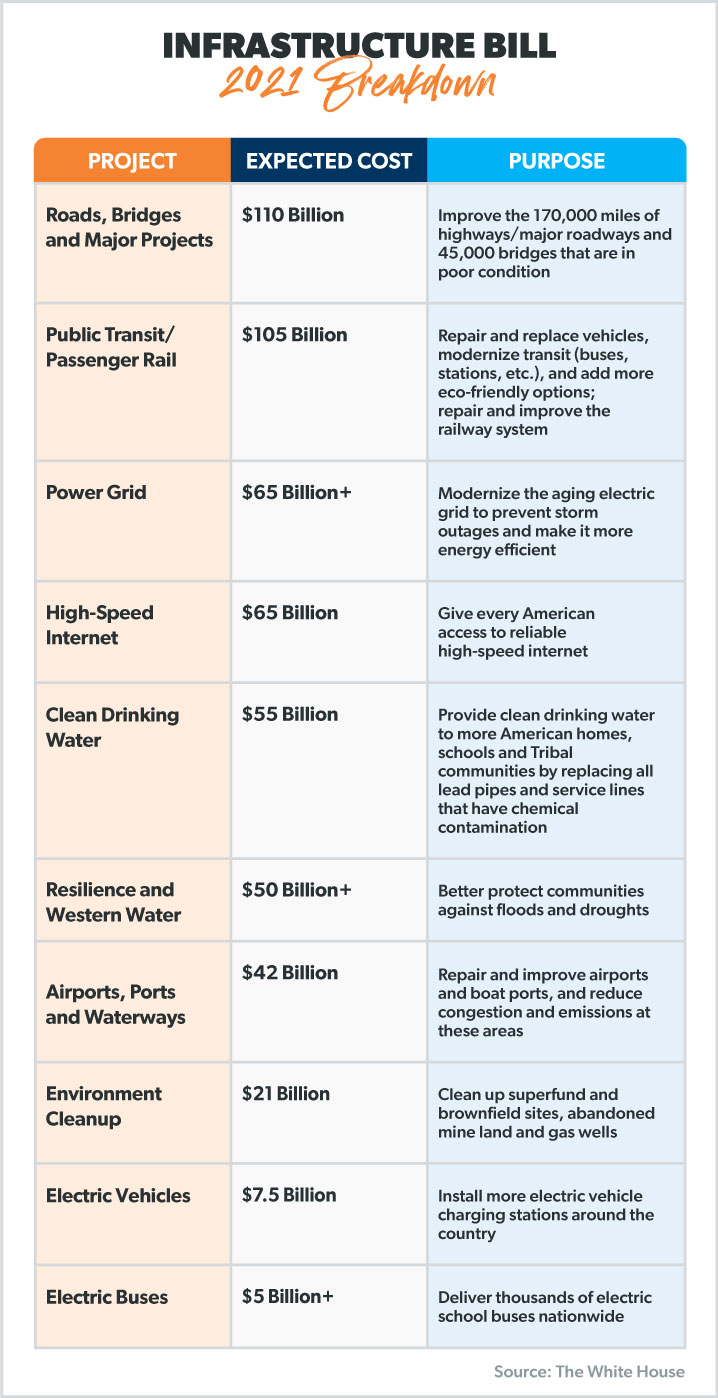

The comprehensive 12 trillion infrastructure package authorizes funds for federal-aid highways highway safety programs and transit programs and for other purposes. Thus congressional action of this bill has been completed. Almost three months after it passed the US.

Tax Provisions in the Infrastructure Investment and Jobs Act While the Infrastructure Investment and Jobs Act of 2021 IIJA is primarily a bill that improves roads bridges and transit as well as authorizing additional funding for energy water and broadband improvement there are some tax-related provisions included. The Infrastructure Investment and Jobs Act Includes Tax-Related Provisions Youll Want to Know About by Joe Wilson CPA MST on November 29 2021 in IRS Taxation-Individuals Almost three months after it passed the US. The Senate passed the bill in August 2021 also with bipartisan support.

House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. However with enactment after the start of the fourth quarter of 2021 some concern has been expressed about the retroactive application of the elimination of the credit Employer-sponsored retirement plans. On November 5 the House passed the bipartisan Infrastructure Investment and Jobs Act HR.

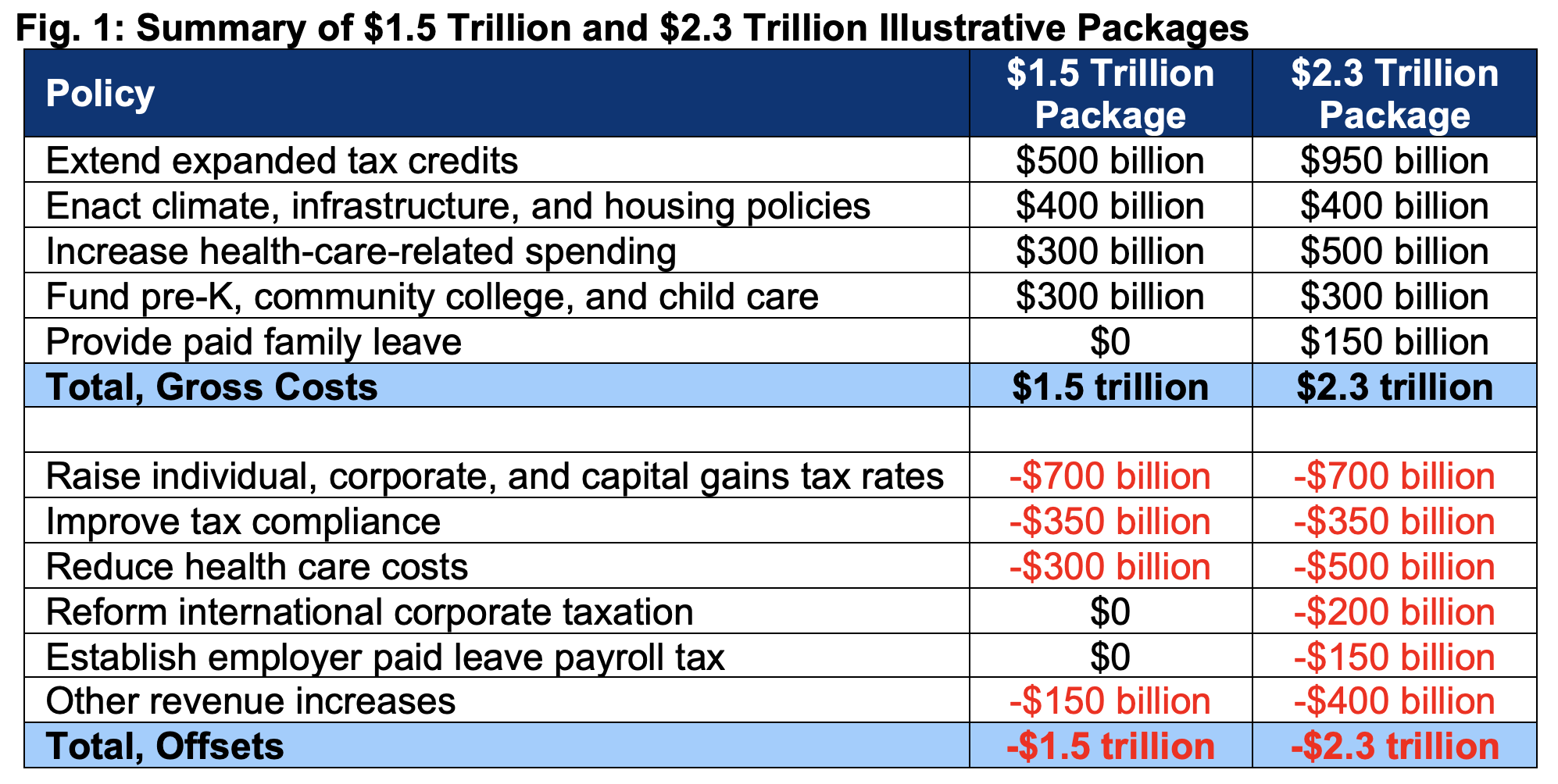

One way the Democrats got Republican buy-in is that early on they substituted tax. While the bulk of the law is directed toward massive investment in infrastructure projects across the country. 30 th and not effective in Q4 and certain.

3684 the Infrastructure Investment and Jobs Act The vote was 228 to 206. While the Infrastructure Investment and Jobs Act of 2021 IIJA is primarily a bill that improves roads bridges and transit as well as authorizing additional funding for energy water and broadband improvement there are some tax-related provisions included. While the bulk of the law is directed toward massive investments in.

Among other provisions this bill provides new funding for infrastructure projects including for. While the bulk of the law is directed toward massive investment in infrastructure projects across the country a handful of noteworthy tax provisions are tucked inside it. Highway and pedestrian safety.

3684 by a vote of 228-206 with the support of 13 Republicans. The Infrastructure Investment and Jobs Act includes tax-related provisions youll want to know about Posted on Nov 10 2021 Almost three months after it passed the US. The Infrastructure Investment and Jobs Act legislation eliminates the credit for wages paid after September 30 2021.

Employee Retention Credit Changes. The legislation includes tax-related provisions. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill.

Almost three months after it passed the US. The IIJA did not include as many tax implications as are likely to be seen in the Build Back Better Act but a few items of note include the ERC sunsetting Sept. Almost three months after it passed the US.

Passenger and freight rail. House of Representatives tonight passed HR. President Biden signed the bill into law on November 15.

New Tax Provisions in the Infrastructure Investment and Jobs Act November 17 2021 On Monday President Biden signed HR 3684 the Infrastructure Investment and Jobs Act into law. Almost three months after it passed the US. The Infrastructure Investment and Jobs Act the bill is historic and transformational legislation that when it becomes law will make available 12 trillion in funding for infrastructure programs across the transportation energy and water sectors.

Tax Provisions in the Infrastructure Investment and Jobs Act. Power and grid reliability and resiliency. 3684 popularly called the Infrastructure Investment and Jobs Act Infrastructure Act in a bipartisan ceremony at the White House.

Infrastructure Investment and Jobs Act Tax-Related Provisions. The Infrastructure Investment and Jobs Act will end the Employee Retention Tax Credit early and create new workforce development. Infrastructure Investment and Jobs Act Includes Several Tax Provisions with Little Fanfare VIEW AS PDF Tax Topics By Don Carpenter MSAccCPA On November 15 2021 President Joe Biden signed into law HR.

Kleiman November 11 2021 Last weeks approval of the more than 1 trillion Infrastructure Investment and Jobs Act IIJA which includes a couple of tax provisions for taxpayers to take note of is on its way to President Bidens desk for his anticipated signature.

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

The Impact Of The Tax Cuts And Jobs Act S Repatriation Tax On Financial Statements The Cpa Journal

Tax Accountant Tax Accountant Accountant Resume Resume Examples

Irs Offers New Identity Protection For Taxpayers Identity Protection Business Tax Deductions Irs

Myths And Facts Infrastructure Investment Jobs Act

What Are The Economic Effects Of The Tax Cuts And Jobs Act Tax Policy Center

Infrastructure Bill Will Terminate Employee Retention Credit Retroactively Tax Withholding Reporting Blog

Joint Venture In India With Foreign Company Joint Venture Indian Amp Foreign Companies In 2022 Exit Strategy Business Structure Private Limited Company